Given that the economy is entering a recession, I'm handling a lot more questions pertaining to investment and through this process, encounter more common misconceptions that retail investors tend to have. In this article, I hope to address 5 of the most common ones and hopefully provide more clarity for investing.

1. Assessing investment returns on a yearly basis or through a short-term timeline

As much as retail investors like to believe they are investing, the truth is most retail investors prefer the role of the speculator but are only willing to stomach the risk of a long-term investor. This disconnect is what makes most retail investors have very misplaced expectations.

For starters, nobody has a crystal ball to tell when market will tank. Hence, a 1 year investment horizon is really highly speculative. In short - gambling. The market might go up straight after you purchase or it may tank right after you purchase. COVID-19 & a global lockdown is a perfect example of something unexpected that can trigger major market movements.

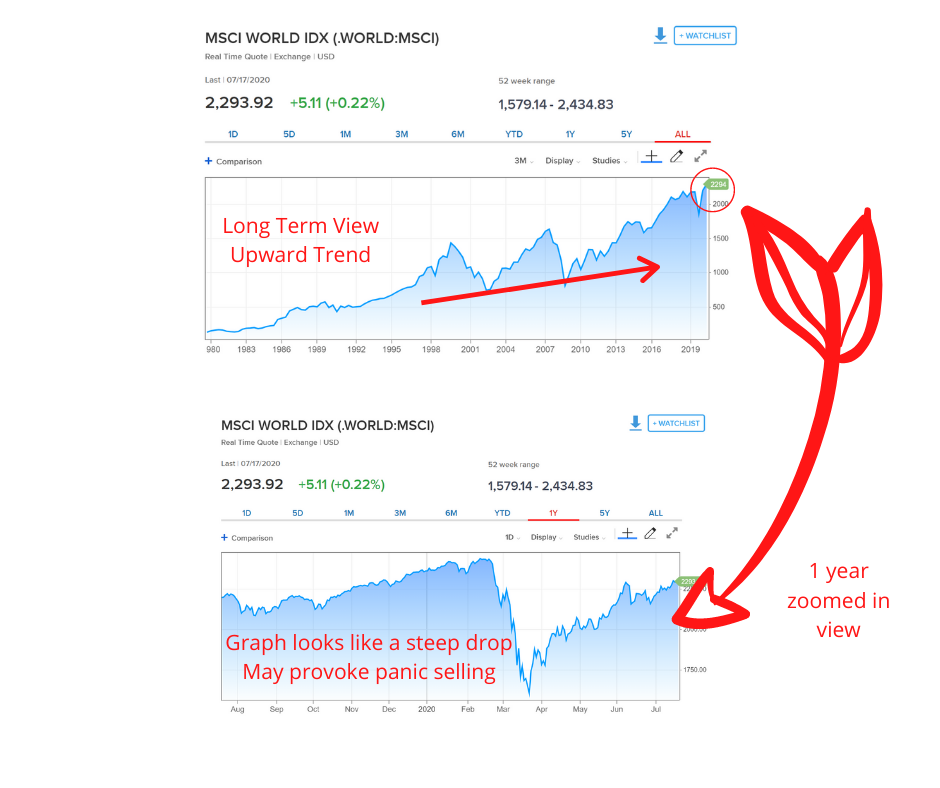

As shared previously in another of my investment article and video, a long term approach to investing tend to reflect less volatility while a short-term approach to the market will zoom in on a lot more volatile movements creating undue fear.

It's not only about what happens in the market, but your reaction to it.

Essentially, it matters very little if you look at market movements daily or once a year if you have a long term outlook. The problem arises when people overreact to short term volatility.

Imagine someone invested in the S&P500 at the peak during 2007 and decided to stay invested for 10 years. During this process, the Subprime Crisis (Lehmann Brothers) caused markets to tank in 2008 and only broken even in 2013. That's 5 entire years in the red! However, if this person stayed invested till 2017 or beyond, the gains would have been minimally 35% over 10 years which is 3.5% each year. If that person held on till today, he/she would have gained 110% which is 8.46% per annum for the 13 year investment period. What a lot of people miss the point in investment is that their expectation of a linear growth. Investments don't function this way as there are ups and downs. However, because the bull period tends to be much longer than the bear period and markets tend to appreciate over time, the long term gains has exponential effects to make up for the time in red. Also, it should be pointed out that it's pretty unlikely that one invests at the end of a bull cycle all the time.

2. Concluding all investments are not profitable because of 1 bad experience

Which leads me to the second point. As people tend to gauge investments on a yearly basis, they may have realised a loss before the market recovers. Additionally, it really depends on what type of investment a person did. Sometimes, investing based on a recommendation or hearsay may result in buying something very niche or specific which may turn out badly. Investments does after all carry risk. Having said that, I'd like to point out that there are also a lot of people who are continuously investing today because they have good experience from the market. It should be noted though that most of these people who have an overall positive experience in the market probably suffered some losses in some individual counters but have an overall gain based on their entire portfolio.

In order to avoid this fallacy of thought, I have 2 advice for you.

Don't put all your funds in a single investment. It's very common for retail investors to put all their funds in 1 fund/stock/instrument. This is because most people find it troublesome to hunt around for alternatives. However, unless you have a crystal ball to determine that this is a definite positive result, it's really gambling. Your odds are 50-50 especially if you are a beginner.

Go for a diversified portfolio. Most of the advice about long-term investing only holds true for diversified portfolios. Ideally, a global one. For specific stocks, funds or ETF, it may not hold true as the scope is too narrow for this principle to apply fully.

3. Concentrating risk in one country or region and mistaking that the portfolio is diversified

A common misconception that retail investors make is thinking that buying more than one stock in a single country is a diversified portfolio. In Singapore, many people have the tendency to buy multiple Singapore stocks and assume they have a diversified portfolio. However, a truly diversified portfolio would reflect investing in instruments that are not co-related. Usually, people diversify through the following: instrument, region, country & industry/sector.

An example of a diversified portfolio may look something like this:

From this example, we can see that in the event the stock market tanks, there's a possibility that the investor is unaffected as he/she has exposure into other instruments like property, precious metals, alternatives (maybe Bitcoin?) and start ups. Of course, sometimes all markets can still be impacted but the degree might differ.

The reason why I'm pointing this out is because I've come to notice that many retail investors' misconceptions are inter-connected. They may be overly concentrated in a particular sector but think they diversified their risk, hence came to a conclusion that all investments in the capital markets don't work. The underlying principle of investment is that a concentrated portfolio earns the most if you bet correctly but a truly diversified portfolio is the most resilient in a downturn.

In the course of my interaction with clients, I've seen portfolios that have around 3 funds skewed towards the Asian Market. 1 fund covering Asia Ex Japan, 1 for Singapore and 1 with HK/China exposure. I thought I'd use this example to illustrate why having a global exposure even within the stock market can be beneficial.

In the image above, I took the Hangseng Index as a representation of the Asian market and also something closer to home which is Singapore. We can see that during the Asian Financial Crisis, both markets tanked more than 50% because of their co-relation to Asia. On the other hand, markets outside Asia while affected, had minimal impact.

The MSCI World Index for example only dropped 15% during the same period which is a sneeze compared to the recessionary impact in Asia. What I am trying to illustrate in the above example on the instances where specific markets or regions may be impacted, an over-concentration in one area would not protect the investor from the risk even if one has diversified their exposure within the small region or country.

4. Assessing their investment in dollar amount rather than Percentage change

So recently someone lamented that his investment gains was only $55. Not worth investing he says. In reality he only invested $600 because he just started doing monthly dollar cost averaging. This translates to a 9% return in 4 short months. Is that good or bad?

Very often retail investors tend to assess their investments based on their nett dollar gains rather than their yield. This can be really misleading. I've once seen an elderly client being very happy with her dividend yielding mutual fund because she sees money credited into her bank account every month but an overall calculation of the yield was actually 1-2% only. She might have been better off putting in the fixed deposit where there is no risk. Likewise, I've seen clients lamenting their earnings is small but in reality the yield is between 5-10%.

It is advisable to assess investments via the yield. This is because the percentage gain/loss will help you determine how much to invest if you wish to have a sizable gain. Likewise, it will help you assess the loss and risk exposure as well. So very simply, if you know the investment return for example performs at 10%, then $1000 investment will yield $100. A $10,000 will earn you $1000 and a $100,000 investment will earn you $10,000. The same applies for losses. If you aren't prepared to invest $10,000 for example, you probably need to take more risk with a smaller investment to get the same $1000. As the saying goes, high risk high return.

5. Opting to save on fees and getting a lower return

The issue about fees gets discussed very often. People want to pay as little as possible, sometimes not at all, to get the best return. On this topic, my personal take is to assess based on returns not cost. For instance, if your own investment is doing 5% and you save on fees but getting someone to do it for you yields 10% nett of fees, then paying someone to do it for you is obviously better right? Even if both doing it yourself and getting someone to do it for you yields 10% nett of fees, I'd still say paying someone to do it is better. This is because doing your own investment takes time. Most retail investors I know do not like assessing the markets weekly or monthly and many do not have the time to do so. So while the fees can be expensive, if the nett gain does not leave you worse off, I don't really see the issue of paying fees.

Some might argue that without these fees they could have earned more. Really? Going by my above scenario, only if you are a savvy investor on your own and outperform the one managing the funds, it's unlikely a person can earn more on their own if they saved on the fees. From the above scenario, if an investor did it on their own and either earn the same or less than someone managing for them, saving on fees does not help them to improve their returns. In fact, they paid more since they earned lesser or equivalent but spent time. On the flip side, paying fees would have gotten them the same return and saved them time, so the retail investor would have gained return & time.

Paying fees is only an issue if one incurs the cost and is worse off than if they did nothing or invested themselves.

Summary

To sum things up, these are the 5 common misconceptions of investing.

Assessing investment performance on a yearly or short term basis. Short term volatility might unsettle emotions making people exit positions prematurely and realizing losses unnecessarily.

Concluding all investments are not profitable based on one bad investment experience. The experience is independent of whether investments can be profitable. Try to diversify your portfolio and not put all your money in one basket.

Concentrating investments in one country or region and mistaking that the portfolio is diversified. Good diversification is when the investments within the portfolio are not co-related. Concentrated portfolios give higher gains when the bet turns out right but diversified portfolios are more resilient during a downturn.

Assessing investments based on dollar value instead of percentage gains. This might be misleading as dollar value is usually dependent on how much money is invested. Percentage gains give an objective overview of the investment performance independent of the amount of money invested.

Opting to save on fees and settling for a lower return. Paying fees is only an issue if a person becomes financially worse off.

If you would like to be guided on your investing journey, please speak to a trusted advisor. You can drop me a message if you would like me to help you with it.

Be sure to share the article if you feel this information is helpful. You will enable a lot more people to learn about protection planning.

Like my page if you would like to read more of such articles. Follow me on Instagram if you would like to receive short lessons/updates on investment, personal growth and savings through my insta-stories.

Disclaimer: The content created are based on my personal opinions and may not be representative to everyone or any organisation. If you have any doubts or queries pertaining to insurance or investment, please seek professional advice from a trusted adviser in an official setting. You may also reach out to me if you do not have a present adviser using the message box under 'Let's Talk'.

Comments