Beginner's Guide To Select The Right Savings Plan For YourSelf

- Janice Yip

- May 1, 2020

- 5 min read

Updated: Feb 15, 2022

Did you know that a search on the weekly best sellers chart at Kinokuniya only reflected one book on finance in their top 20 books? Financial literacy in Singapore is improving, however the gap in financial knowledge for most people is still very big. Over my financial planning career, one common problem I come across with most clients is a knowledge gap about the type of solutions that are available to them.

In today's article, my goal is to provide a short, systematic series of questions that can help you ensure that the plan recommended to you by your advisor meets your requirements.

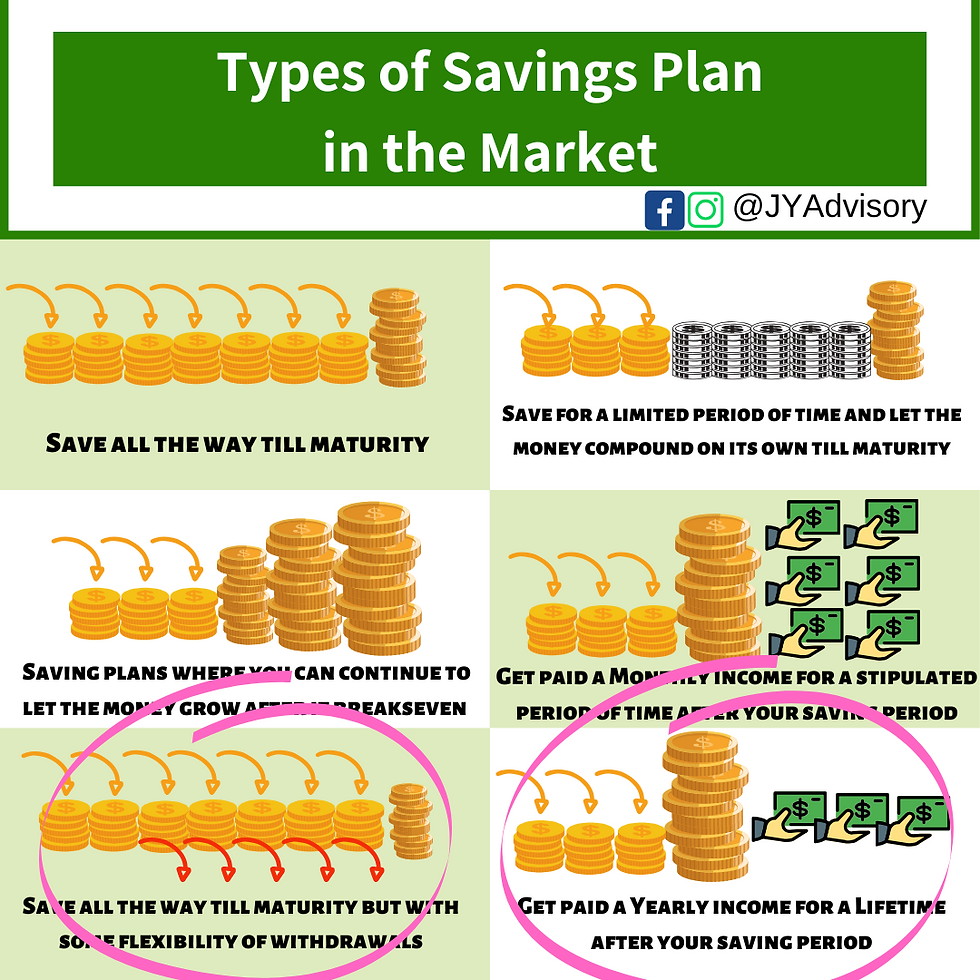

Types of Endowment Plans Out There

Did you know there are at least 6 different types of endowment plans in the regular premium category? To find out how each plan work, read my article on Types of Savings Plans In The Market. So now, the golden question:

If there are so many plans in the market, how do I know which is most suitable for me?

Before we kick start the process to provide some logical guidance, I'd like to highlight a few assumptions made in this exercise.

Whoever implementing this has a regular income, and sufficient surplus to commit long term.

They have sufficient emergency funds and monthly expenses are around 50% or less.

The funds committed to endowments generally have at least a 15 year time horizon where the funds are not needed.

1. Is there a specific purpose for your endowment or do you simply want to set aside some savings which you may or may not use in the future?

Now, you may ask how is it possible to take up a commitment without a functional purpose for the plan? Over my interaction with many clients and prospects, there are more people who take up plans with the sole intention to save money than people who take up plans for specific goals. However, being able to differentiate whether there's a specific purpose for your endowment makes a difference in terms of the solution you end up with.

There are endowment plans that will continue to compound as long as clients do not terminate the plan. Such plans meet the needs of people who only wish to save and have no specific timeline on when they need the money. This is because if they get plans with fixed maturities, they may run into reinvestment risk subsequently should they not need the funds. However, if they take up similar plans to be used for purposes that are timeline specific, then the plan's returns might not be fully maximized as compared to other solutions in the market.

2. When the money matures, do you prefer it as a lump sum or through a regular income stream?

This is very important because this will help you to eliminate about half the available solutions in the market once you decide. Now to determine what to choose, it's simply a combination of preference and practicality.

Take for example, if you are looking to save up money to down-pay a second property in 15 to 20 years time, obviously you need a lump sum right? However, if you need the money for retirement, then it's a question whether you prefer to have a huge sum of money which you manage on your own or have a regular income that ensures you don't overspend. The idea of CPF Life is based fundamentally on the fear that citizens might overspend if given all the money at one go. Again, if you need this money for your child's education, do you prefer to have the full amount on hand when they reach Tertiary Education or are you alright with the payout being paid to you in 3-5 years given that school fees are usually collected per semester.

3. Can you finance the plan till retirement or is there a limited period you can pay for the plan?

This question assumes that we either don't have a lump sum we can part with at one go or that we wish to save for a longer period because we have time on our side. So for most of us, if we see ourselves working till retirement, we will expect to be saving till we stop work. Having said that, some of us just psychologically prefer to finish our fixed commitments earlier. It is also possible that there are practical concerns such as women who see themselves stopping work or taking on a less stressful job when they have kids. I also want to point out that for the plans that are limited pay, some also offers the option to pay till retirement.

4. Do you need a portion of the funds to be liquid after a certain commitment period?

Endowments are supposedly long term commitments. Precisely because it's long term, sometimes clients need to have some flexibility to withdraw a portion of their savings before the plan matures. Now, if any advisor were to ask this question, at least 8/10 people will say they want liquidity. Psychologically, we feel safer when we can access some money. However, flexibility usually comes at a price. The reason why this consideration is important is because having such a feature might affect the return and the guaranteed amount in the plan.

Usually, the first 2 years are the most crucial period where people might face difficulty adjusting to the new financial commitment. It is also the period where most plan lapses happen. All endowments do not allow withdrawals within the first 2 years. What's interesting based on my experience, clients who can comfortably commit to the plans for 2 years or more will not want/need to use the cashback feature even if they have that option. The reason for this is because the intention of taking up the plan in the first place is meant for a longer term goal. Taking out money from the plan will bring them further away from the goal. If this is the case, then having a plan without a cashback feature might leave the client better off.

Piecing the guide together

1. Random Savings or Specific Purpose

2. Lump Sum or Income Stream

3. Short Payment Term or Long Payment Term

4. Need Partial Liquidity or No Need Partial Liquidity

With this short guide, you will have a gauge on whether the recommendations made to you are suitable. For example, if you are recommended a fixed duration plan when you do not have a fixed timeline on when you need the money, you should ask why. Or if you are given a plan with an attractive liquidity feature which you do not need it, then you might want to scrutinize the plan further to see if you are compromising on the returns as compared to a similar plan without liquidity.

In short, this guide is a mix and match similar to a if/or scenario based guide. My personal take on an advisory process is one where the advisor guides clients to arrive at solutions ideal for clients' needs. Largely due to the complexity of most financial products as well as its ever changing nature, the guide is not designed as a DIY tool. Rather, it's written as a logical thought process to facilitate clients in finding a suitable recommendation for themselves with the help of a financial advisor.

If you are thinking of getting an endowment/savings plan for yourself, please speak with a trusted advisor. Alternatively, you can drop me a message if you would like me to help you with it.

Be sure to share the article if you feel this information is helpful. You will enable a lot more people to learn about financial literacy. Like my page if you would like to read more of such articles. Follow me on Instagram if you would like to receive short lessons/updates on investment, personal growth and savings through my insta-stories.

Disclaimer: The content created are based on my personal opinions and may not be representative to everyone or any organisation. If you have any doubts or queries pertaining to insurance or investment, please seek professional advice from a trusted adviser in an official setting. You may also reach out to me if you do not have a present adviser using the message box under 'Let's Talk'.

Comments